Choosing the right business structure is one of the most important decisions you’ll make as a startup founder. Your choice will impact your tax obligations, liability, ability to raise capital, and even day-to-day operations. In this article, we’ll explore the different Business Structure Types and help you understand which is best suited for your startup.

Why Business Structure Matters for Startups

The Role of Business Structure

The business structure you choose sets the legal foundation for your company. It influences everything from taxes and liability to how your startup can expand. For instance, some structures allow for more flexibility in ownership, while others are more rigid but offer greater protection.

Factors to Consider When Choosing a Business Structure

There are several factors to consider when choosing your business structure, including:

- Liability protection

- Tax implications

- Ownership structure

- Management flexibility

- Ease of raising capital

Types of Business Structures

1. Sole Proprietorship

What is a Sole Proprietorship?

A sole proprietorship is the simplest and most common business structure. It’s an unincorporated business owned and operated by one person, making it easy to set up with minimal paperwork.

Advantages of Sole Proprietorship

- Easy Setup: Requires little to no formal documentation.

- Full Control: The owner has complete control over decision-making.

- Tax Benefits: Income is reported on the owner’s personal tax return, simplifying tax filing.

Disadvantages of Sole Proprietorship

- Unlimited Liability: The owner is personally liable for business debts.

- Difficulty Raising Capital: Sole proprietorships often struggle to raise funds from investors.

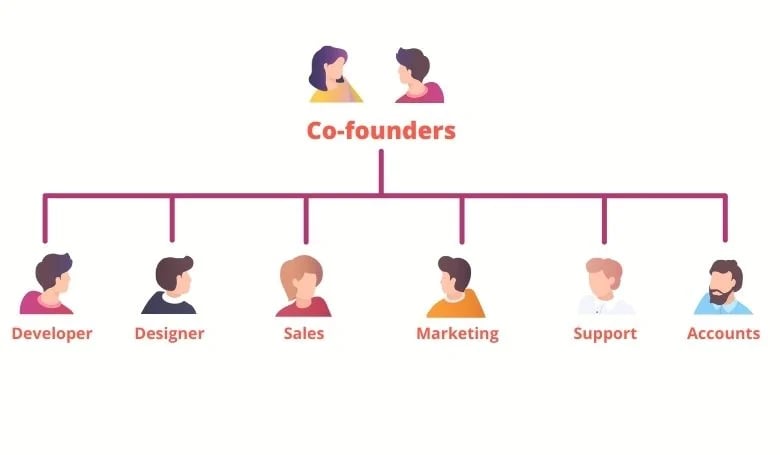

2. Partnership

What is a Partnership?

A partnership is a business owned by two or more people. Partnerships can be either general partnerships (where all partners share equal responsibility) or limited partnerships (where some partners have limited liability).

Advantages of Partnerships

- Shared Responsibility: Partners can share the workload and decision-making.

- Taxation: Partnerships benefit from pass-through taxation, meaning profits are taxed on partners’ personal returns.

- More Resources: Multiple partners can bring in additional capital and expertise.

Disadvantages of Partnerships

- Joint Liability: In general partnerships, all partners are liable for business debts.

- Potential for Conflict: Disagreements between partners can disrupt business operations.

3. Limited Liability Company (LLC)

What is an LLC?

A Limited Liability Company (LLC) is a hybrid structure that combines the benefits of both partnerships and corporations. Owners, known as members, enjoy limited liability while also benefiting from pass-through taxation.

Advantages of an LLC

- Limited Liability: Members are not personally liable for the company’s debts.

- Tax Flexibility: LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation.

- Management Flexibility: LLCs offer flexibility in ownership and management structures.

Disadvantages of an LLC

- Cost: Setting up an LLC can be more expensive than a sole proprietorship or partnership due to filing fees and ongoing compliance costs.

- Varying State Laws: LLC regulations vary by state, which can complicate setup and operations.

4. Corporation (C Corp)

What is a C Corporation?

A C Corporation is a separate legal entity owned by shareholders. It offers the strongest protection against personal liability but is subject to double taxation (profits are taxed at the corporate level and again when distributed to shareholders).

Advantages of a C Corporation

- Limited Liability: Owners (shareholders) are not personally liable for the company’s debts.

- Unlimited Growth Potential: C Corporations can raise capital by issuing shares.

- Perpetual Existence: A corporation continues to exist even if the owners or shareholders leave the company.

Disadvantages of a C Corporation

- Double Taxation: Profits are taxed at both the corporate and shareholder levels.

- Complexity and Costs: Setting up and maintaining a C Corporation requires extensive paperwork and compliance.

5. S Corporation (S Corp)

What is an S Corporation?

An S Corporation is a special type of corporation that allows profits to pass through to shareholders’ personal tax returns, avoiding double taxation. However, it has stricter ownership rules.

Advantages of an S Corporation

- Avoids Double Taxation: Profits pass through to shareholders’ personal tax returns, avoiding corporate taxes.

- Limited Liability: Like a C Corporation, owners are not personally liable for business debts.

Disadvantages of an S Corporation

- Ownership Restrictions: S Corporations can have no more than 100 shareholders, and they must be U.S. citizens or residents.

- Stricter Formalities: S Corporations must follow stricter operational rules than LLCs or sole proprietorships.

Expert Insights on Choosing the Right Business Structure

Case Study: Choosing an LLC for Flexibility

Many startups opt for an LLC due to its flexibility and liability protection. For example, a tech startup in California chose to form an LLC, which allowed the founders to easily manage ownership and liability while still benefiting from pass-through taxation. As the company grew, they considered converting to a C Corporation to attract investors.

Expert Quote: Barbara Weltman on Business Structures

“Choosing the right business structure is one of the first and most important decisions you’ll make as a business owner. It impacts how you’re taxed, your liability, and even how you operate your business daily.” – Barbara Weltman, Tax and Business Attorney.

Emerging Trends in Business Structures

1. Hybrid Entities

New hybrid business structures are emerging that combine elements of different types. For instance, the B Corporation (Benefit Corporation) is gaining popularity among startups focused on social impact. This structure allows businesses to pursue profit while also considering social and environmental factors.

2. Remote-First Business Models

As more companies adopt remote-first models, certain structures may be more beneficial for tax purposes or compliance with multiple jurisdictions. LLCs and S Corporations offer more flexibility for remote teams.

Practical Tips for Startup Founders

1. Consult with Legal and Financial Experts

Before settling on a business structure, it’s essential to consult with legal and financial advisors. They can help you understand the implications of each structure in your state and ensure your choice aligns with your long-term goals.

2. Plan for Future Growth

As your business evolves, your structure may need to change. If you plan to raise capital or expand internationally, consider how your current business structure will accommodate future growth.

Conclusion

Choosing the right business structure for your startup is a critical decision that will impact your company’s operations, taxes, and liability. While sole proprietorships and partnerships offer simplicity, LLCs and corporations provide better protection and flexibility. By understanding the advantages and disadvantages of each structure, you can make an informed decision that aligns with your business goals.

Final Thoughts

Don’t rush the decision. Take the time to evaluate your options, consult with experts, and consider your long-term vision for the business. The right business structure is a key factor in building a solid foundation for growth and success.

FAQs

- What is the best business structure for a startup?

It depends on your goals. LLCs offer flexibility, while corporations are ideal for raising capital. - What is the difference between an LLC and a corporation?

An LLC offers pass-through taxation and flexibility, while a corporation provides stronger liability protection but is subject to double taxation. - Do I need a lawyer to set up a business structure?

While not required, it’s recommended to consult with a lawyer or financial expert to ensure you choose the best structure for your startup. - Can I change my business structure later?

Yes, many startups change their structure as they grow or seek outside investment. - How does my business structure affect taxes?

Each structure has different tax implications. For example, sole proprietorships and LLCs have pass-through taxation, while corporations face double taxation.